First Time Insurance Buyers ?

Finding Car Insurance for First Time Buyers in 2025: Your Complete Guide simplifies the process and empowers first-time insurance buyers to make confident decisions. Finding Car Insurance for First Time Buyers in 2025: Your Complete Guide simplifies the process and empowers first-time insurance buyers to make confident decisions. With countless options and unfamiliar terms, finding the right policy might

seem daunting, for the first time insurance buyers. Don’t worry! This guide will break down everything you need to know as a

first-time buyer, empowering you to make confident decisions.

Check Which Focus Keywords is being detected by Math SEO plugin

Why First-Time Buyers Need Car Insurance

Car insurance isn’t just a legal requirement; it’s your financial safety net. As a first-time buyer,

you’ll want to protect yourself against unforeseen accidents, damages, and liabilities. Here are the

key reasons:

● Legal Compliance: Most states require minimum liability coverage to legally drive.

● Financial Protection: Covers repair costs, medical bills, or legal fees in case of an

accident.

● Peace of Mind: Knowing you’re protected allows you to drive with confidence.

For instance, imagine accidentally bumping into another car in a crowded parking lot. Without

insurance, you’d bear the repair costs entirely on your own. With a comprehensive policy,

however, you’re covered.

Understanding Car Insurance Coverage Types

Before diving into the purchase process, familiarize yourself with the main coverage options:

1. Liability Insurance

○ Covers damages to other people’s property or injuries caused by you.

○ Required in most states.

2. Collision Coverage

○ Pays for damages to your car from collisions, regardless of fault.

3. Comprehensive Coverage

○ Protects against non-collision events like theft, vandalism, or natural disasters.

4. Personal Injury Protection (PIP)

○ Covers medical expenses for you and your passengers.

5. Uninsured/Underinsured Motorist Coverage

○ Protects you if the at-fault driver lacks adequate insurance.

How to Choose the Right Policy

Follow these steps to find the perfect car insurance for your needs:

1. Assess Your Needs

○ Determine how much coverage you require based on your car’s value, driving

habits, and budget.

2. Compare Providers

○ Shop around and compare quotes from multiple insurers.

○ Check reviews and customer ratings for reliability.

3. Understand Policy Terms

○ Pay attention to deductibles, limits, and exclusions.

4. Leverage Discounts

○ Many insurers offer discounts for first-time buyers, good driving records, or

bundling policies.

For more tips on saving money, visit our detailed guide: How to Save on Car Insurance.

Common Mistakes to Avoid

1. Underestimating Coverage Needs

○ Opting for minimum coverage might save money upfront but can be costly

in the long run.

2. Ignoring Discounts

○ Always inquire about available discounts for students, safe drivers, or

multi-policy holders.

3. Skipping Policy Reviews

○ Regularly review your policy to ensure it meets your evolving needs.

Real-Life Story: Learning the Hard Way

Jake, a first-time car owner, chose the cheapest policy available without reading the terms. A

minor fender-bender left him with unexpected out-of-pocket expenses because his policy didn’t

cover collision damages. He later switched to a comprehensive plan, appreciating the value of

adequate coverage.

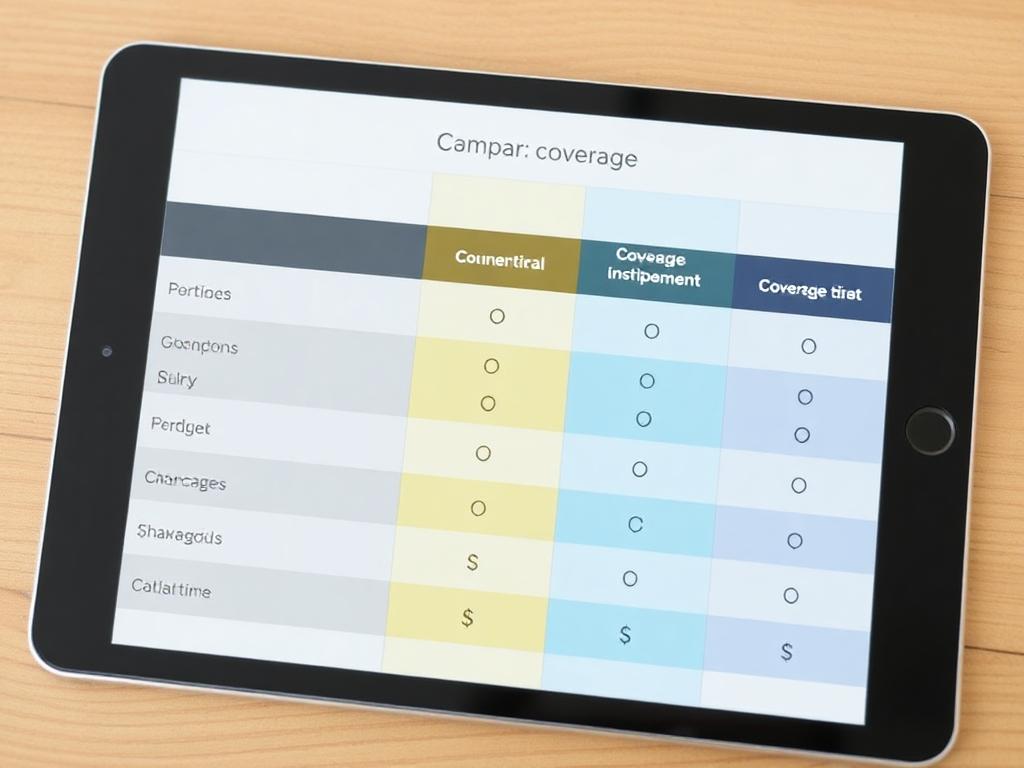

Comparison of Coverage Types

[table id=2 /]

FAQs

Q1: How much does car insurance cost for first-time buyers? A: The cost varies based on factors

like age, location, car type, and coverage. On average, first-time buyers might pay higher

premiums due to limited driving history.

Q2: Can I get car insurance without a driving history? A: Yes, many insurers offer policies to new

drivers, though premiums might be higher initially.

Q3: Should I choose the minimum required coverage? A: While it’s cheaper, consider

comprehensive coverage to protect against unforeseen events.

Q4: How can I lower my premium as a first-time buyer? A: Consider higher deductibles, maintain a

clean driving record, and inquire about discounts.

Conclusion

Car insurance is a crucial investment for first-time buyers. It not only ensures legal compliance

but also safeguards your financial well-being. By understanding your coverage options,

comparing providers, and avoiding common pitfalls, you can confidently choose a policy that fits

your needs. Start your driving journey on the right foot—protect yourself and your car with the

perfect insurance plan. Explore more about smart insurance strategies on XpertCodes today!

For More Information See Our Previous post Car Insurance For Bad Credit Drivers

If your website is not functioning properly or has any issues, visit our site at XpertCodes for assistance.

2 comments