Cash Value Life Insurance in Portugal Secure Your Future with Smart Investments, Cash value life insurance is a unique financial tool that blends life protection with a savings component. In Portugal, this form of insurance has gained popularity among those seeking both security and a reliable investment avenue. This article explores the ins and outs of cash value life insurance, why it’s becoming a preferred choice, and how to choose the best policy for your needs.

What Is Cash Value Life Insurance?

Cash value life insurance is a type of permanent life insurance that accumulates a cash value over time. Part of your premium goes toward the life insurance coverage, while the remainder is invested in a savings account or fund. This cash value grows over time, providing a resource you can borrow against or withdraw under certain conditions.

Benefits of Cash Value Life Insurance in Portugal

Dual Purpose: Protection and Savings

- Life Protection: Ensures financial support for your loved ones in the event of your passing.

- Savings Component: Accumulates value over time, acting as a long-term investment.

Tax Benefits

In Portugal, cash value life insurance policies often come with tax advantages, such as deductions or tax-free withdrawals under specific circumstances.

Financial Flexibility

You can borrow against the cash value or use it as collateral for loans, offering liquidity in times of need.

Challenges of Cash Value Life Insurance and Solutions

Higher Premiums

Cash value life insurance tends to have higher premiums than term insurance.

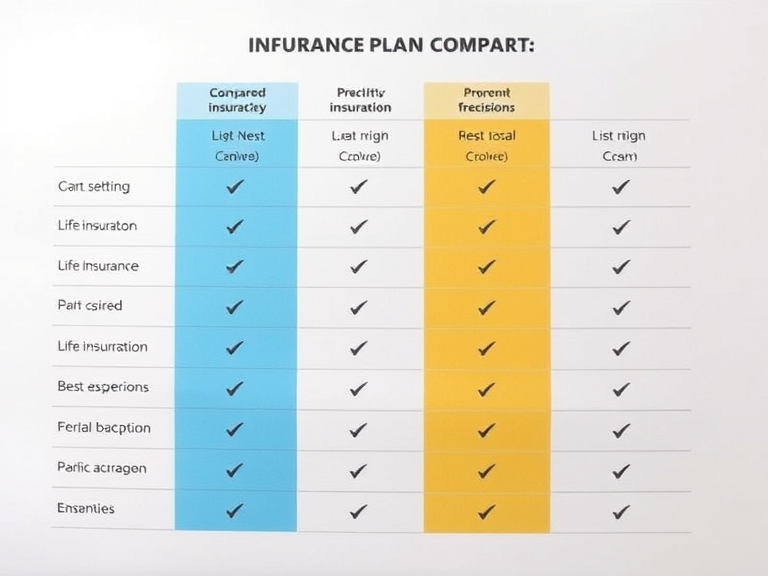

Solution: Compare multiple providers to find policies that balance coverage and cost effectively.

Complexity

Understanding the terms and conditions of cash value life insurance can be challenging.

Solution: Work with a trusted financial advisor to ensure clarity and suitability.

Tips for Choosing Cash Value Life Insurance in Portugal

- Assess Your Goals: Determine whether you value savings growth, life protection, or both.

- Compare Providers: Look for insurers with a strong reputation and competitive offerings.

- Review Policy Terms: Understand the fees, surrender charges, and borrowing conditions.

Conclusion

Cash value life insurance in Portugal is a versatile solution for those seeking a mix of financial security and investment opportunities. With its dual benefits of life protection and cash accumulation, it’s an excellent option for long-term planners.

Ready to explore your options? Contact a trusted provider today to secure your financial future and provide for your loved ones with cash value life insurance.

The Growing Demand for Cash Value Life Insurance in Portugal

Portugal’s evolving financial landscape has made cash value life insurance an attractive option for individuals seeking comprehensive financial solutions. With rising awareness about long-term planning and the need for financial security, this insurance type has become more than just a safety net—it’s a strategic investment tool.

Unlike traditional life insurance, cash value policies offer a dual advantage. They not only ensure that your loved ones are financially protected but also provide a tangible benefit during your lifetime. The cash value can be accessed to fund major expenses, such as education, property investments, or even retirement needs.

Why It’s Important to Act Early

One of the most significant advantages of cash value life insurance is the compounding growth of the savings component. The earlier you invest, the more time your money has to grow. Young professionals and families in Portugal are increasingly recognizing the importance of starting early to maximize their policy’s value.

Additionally, insurers in Portugal are innovating their offerings, with policies tailored to different life stages and financial goals. Whether you are a young professional or planning for retirement, there’s likely a cash value life insurance plan designed to meet your needs.

Bonus Tips

Learn more about The Ultimate White Label WordPress Agency (Agency WordPress) on Website White Labeling.

Discover 5 Reasons to Trust MyFastBroker Insurance Brokers for Hassle-Free Coverage to keep premiums low.

If your website is not functioning properly or has any issues, visit our site at XpertCodes for assistance.