7 Amazing Car Insurance Options without a Down Payment for Budget-Savvy Drivers. For many drivers, the idea of paying a hefty down payment for car insurance can be daunting. Luckily, several insurance providers offer flexible policies that don’t require an upfront payment. These options are perfect for budget-conscious individuals who want reliable coverage without breaking the bank.

In this guide, we’ll explore seven incredible car insurance options that eliminate the need for a down payment while offering excellent benefits.

What Does ‘No Down Payment’ Mean in Car Insurance?

When insurers waive the down payment, they allow you to begin coverage without requiring a lump sum upfront. Instead, your premium is divided into smaller, manageable monthly payments.

Benefits of No Down Payment Insurance:

- Immediate Coverage: Drive with peace of mind without waiting to save for a large initial payment.

- Budget Flexibility: Easier on your wallet with evenly distributed monthly costs.

- Inclusive Options: Available to drivers with varying credit histories.

7 Amazing Car Insurance Options without a Down Payment for Budget-Savvy Drivers

1. Geico

Why It’s Great: Geico is known for affordable premiums and flexible payment options. Their no down payment policies make it easy to get coverage quickly.

- Features: Low monthly payments, online account management, and 24/7 customer service.

- Best For: First-time drivers and those with tight budgets.

2. Progressive

Why It’s Great: Progressive’s Name Your Price Tool allows you to customize a policy based on your budget. No down payment? No problem.

- Features: Accident forgiveness, flexible billing options, and multi-policy discounts.

- Best For: Drivers looking for tailored coverage.

3. State Farm

Why It’s Great: State Farm offers competitive rates and lets you start coverage immediately without an upfront cost.

- Features: Personalized quotes, mobile app access, and bundling discounts.

- Best For: Drivers with family vehicles.

4. Allstate

Why It’s Great: Allstate provides affordable policies with no down payment and plenty of optional add-ons for full customization.

- Features: Accident forgiveness, safe driving rewards, and app-based tracking.

- Best For: Drivers wanting robust policy features.

5. Nationwide

Why It’s Great: With Nationwide, you get affordable monthly plans and a strong reputation for customer satisfaction.

- Features: Vanishing deductible, 24/7 support, and customizable plans.

- Best For: Safe drivers seeking flexibility.

6. The General

Why It’s Great: The General is known for providing coverage to drivers with less-than-perfect credit or driving records.

- Features: Quick approvals, flexible terms, and high acceptance rates.

- Best For: High-risk drivers.

7. Dairyland Insurance

Why It’s Great: Dairyland specializes in affordable plans without large upfront payments, making it ideal for budget-conscious drivers.

- Features: SR-22 options, flexible payment plans, and solid customer support.

- Best For: Drivers needing specialized coverage.

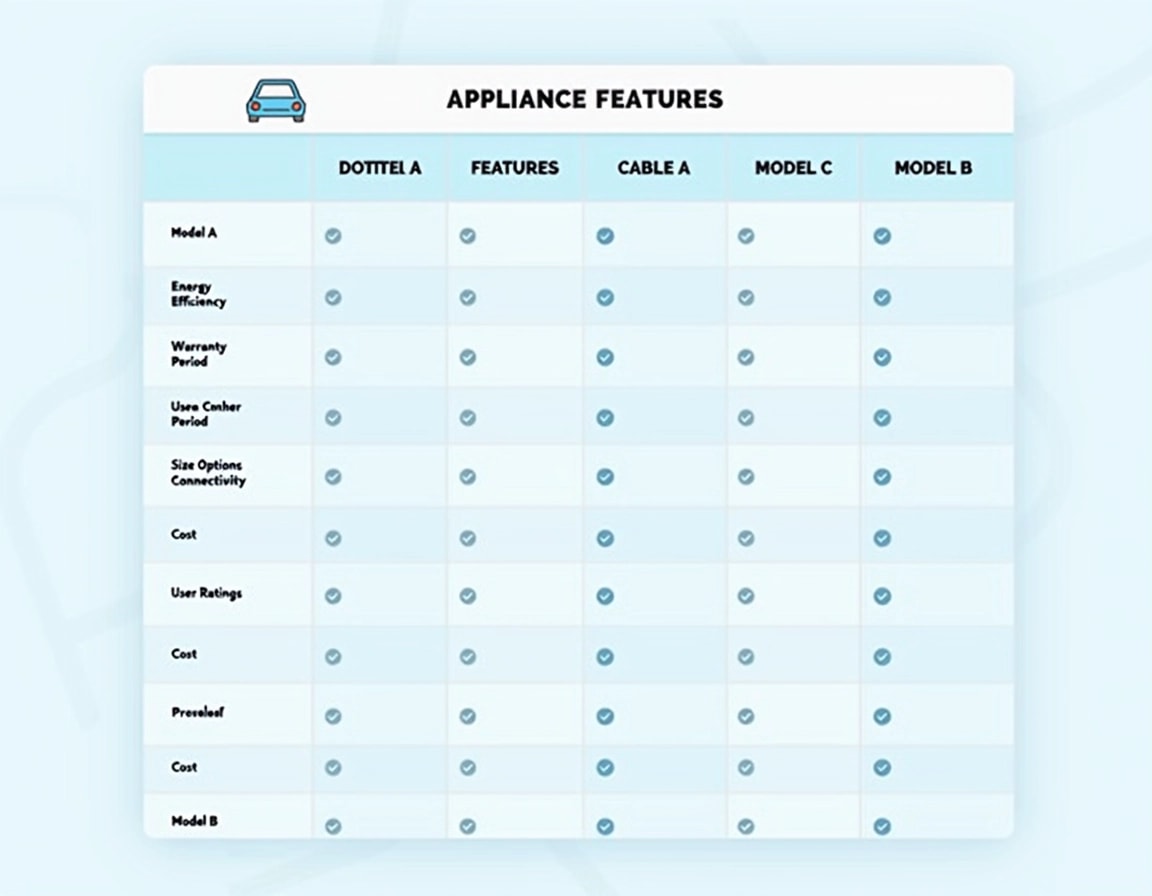

Comparison Table of Providers

[table id=6 /]

Why Choose No Down Payment Insurance?

- Ease of Access: Start coverage without the financial strain of a large initial payment.

- Affordable Monthly Costs: Manage your budget effectively with spread-out payments.

- Inclusive Policies: Options available for drivers with varying credit or driving histories.

FAQs About No Down Payment Insurance

- Can I get full coverage with no down payment?

Yes, many providers offer full coverage plans without requiring an upfront payment. - Are there any hidden fees?

Some providers may charge slightly higher monthly premiums, so it’s essential to read the fine print. - Does my credit score affect eligibility?

Some providers might consider your credit, but many cater to drivers with all credit levels.

Conclusion

Securing car insurance without a down payment doesn’t have to be complicated. With these seven amazing options, you can enjoy immediate coverage, budget flexibility, and peace of mind. Whether you’re a first-time driver, a high-risk driver, or just looking for savings, there’s a provider out there for you.

Start exploring your options today, and take the wheel confidently without worrying about upfront costs!

Bonus Tips

Learn more about Low-cost car insurance for part-time drivers In 2025 on insurance.

Discover Car Insurance for First Time Buyers In 2025 to keep premiums low.

If your website is not functioning properly or has any issues, visit our site at XpertCodes for assistance.